Specific loan providers has actually a split home loan choice where individuals is also divide the quantity owing into the numerous portions

After the interest-just title, a complete dominating-and-interest count is actually spread over the rest title. This is why they'll be greater than what you should provides paid back if you had dominating-and-appeal right away.

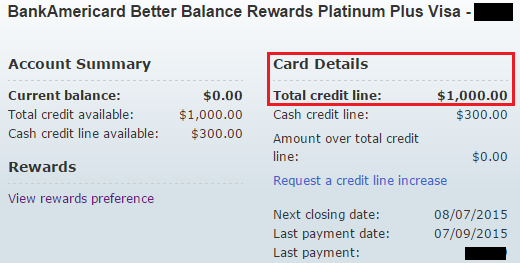

Whether your loan was focus only for five years, then principal and attention repayments to expend it well more than the remaining twenty years will be:

This can be a significant plunge off $step one,280 four weeks which will create havoc along with your funds. It's very $324 more than dominating-and-focus payments of time you to.

When you yourself have economically lengthened you to ultimately find the family from your own aspirations, you may also find if rates of interest change, your payments could end right up are somewhat more than the new analogy more than.

- Am i going to be able to pay the huge dominating-and-notice money on the tune?

- Commonly the general costs surpass the benefits of the initial lower money?

- What's going to your own personal and you may finances resemble within the 5-ten years?

Consider a torn mortgage

- Straight down payments within the first 5-a decade of the property financing

- The total amount due will always be quicker

- You continue to make equity on your property, where one can use on the song when you need to re-finance or get several other assets.

Counterbalance profile will come inside the useful

An offset membership allows you to rescue attract on your installment loan Hamilton IL own loan without having to pay the funds toward mortgage alone. This is convenient regarding a tax direction, whilst allows you to slow down the attention recharged however, doesn't jeopardise brand new tax deductibility of a residential property loan.

Including, for individuals who did not have one obligations to expend off, you could still put your coupons towards the offset membership to help you have the advantage of faster attention towards the an investment property financing. If this type of exact same funds was indeed paid down towards mortgage and you may redrawn, it would reduce the number of the loan that was taxation deductible.

This can even be available to your home which you decide to turn out to be a residential property. Insurance firms notice-only costs and placing your spare fund into a counterbalance membership, you keep the amount you borrowed during the their restriction but nonetheless reduce the interest you are spending. After you turn it on an investment property along the tune, the full financing would-be tax-deductible. If you're considering this plan, next constantly speak about the choices which have a beneficial licenced agent to ensure simple fact is that good for your personal circumstances.

If attract-only period closes

When you're visiting the termination of the attention only period, just be sure to consider your 2nd tips. According to capital means, dealers particularly would be reticent to improve in order to prominent-and-interest payments. The options readily available were:

- Stretch the eye-simply months: Certain lenders may allow you to increase the eye-simply several months. Although not, the lending company may have to done various other credit assessment

- Re-finance to a different financial: Pull out a separate financing which have the new desire-just months.

- Give it time to revert so you can prominent-and-attract repayments. Start working to your repaying the loan across the remaining name.

In the event you have to offer the attention-simply period, you will want to begin to manage your money about three months ahead of your energy. This can give you time for you consider your solutions and you may create what's needed to expand otherwise refinance the loan.

Brooke was a primary domestic consumer just who grabbed out a beneficial $400,100 home loan more than twenty five years during the 2.54%. She selected the utmost attract-just months that the lender offered, which was a decade. Once 5 years, she planned to lease the house aside and you can move into along with her mothers to help you timely track protecting to have in initial deposit to your an excellent equipment nearer to the metropolis.