Step 3: Research rates for the best mortgage re-finance prices

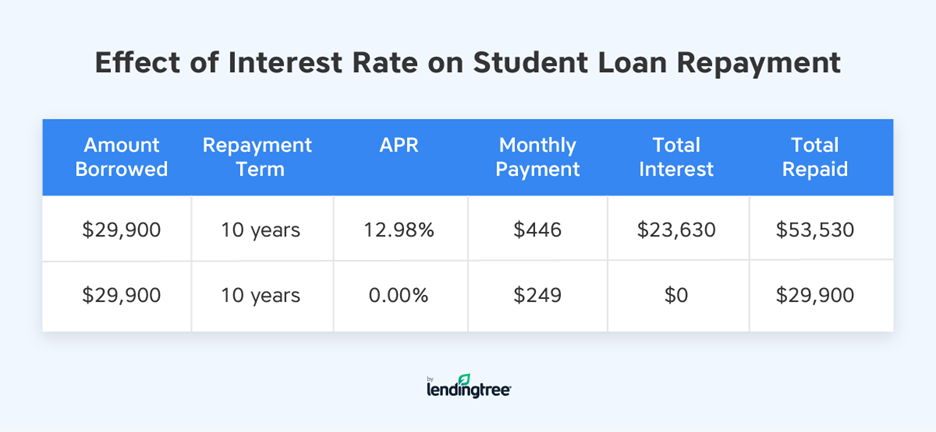

Refinancing your own financial can help you hold the ideal refinance costs and probably save yourself thousands of dollars across the lifetime of their financing. Following this action-by-step publication, you will find a minimal mortgage refinance rates readily available.

Step 1: Assess your financial situation

Before you start wanting a knowledgeable financial re-finance prices, grab a close look at the financial situation. Dictate your credit score, because often notably change the reduced refinance cost you might qualify for. Assemble debt documents, plus evidence of money, assets, and you may debts, to aid streamline the program procedure.

Step two: Lay their refinancing specifications

Pick the majority of your requirements for refinancing. Searching in order to keep the lower home loan refinance cost so you can reduce your monthly premiums? Do you wish to option of an adjustable-speed home loan to a predetermined-rates mortgage? Or perhaps you need to utilize their house's security having renovations or debt consolidation. Wisdom their expectations will allow you to get the best refinance cost tailored to the demands.

To get the lowest re-finance rates, it's important to examine now offers from several lenders. Start by requesting prices from the newest financial, as they can offer competitive cost to hold your organization. After that, search on line lenders, banking institutions, and you can credit unions to discover the best refinance prices readily available. Don't neglect to imagine points beyond rates, such as for example closing costs, fees, and you will financing terminology.

Step 4: Sign up for the borrowed funds

Once you've known the lending company offering the greatest financial refinance pricing, it's time to submit the application. Deliver the expected files, including evidence of earnings, employment background, and you will assets pointers. The lender might perform a home assessment to find the most recent value of your house.

Step 5: Secure your own interest

If you're satisfied with a decreased re-finance costs offered, thought securing on your own interest rate. This handles you against prospective speed develops inside financing running several months. Understand that speed tresses generally include a conclusion big date, so be sure to close the loan in specified timeframe so you're able to support the ideal re-finance rates.

Action six: Close the loan

Shortly after your loan is approved and you may canned, it's time to personal the offer. Feedback your closing revelation meticulously so as that the new conditions, like the lower financial refinance cost, meets everything decideded upon. Spend people closing costs and you can signal the mandatory documentation in order to conduct the refinance.

Keep in mind refinancing a mortgage are a customized experience one utilizes certain facts, as well as your financial predicament together with information on your and you can the newest money. Although a primary-go out house client, refinancing can be an excellent step when lowest refinance costs is actually available.

Still, by using these types of procedures and doing your research for the best home loan re-finance pricing, you can possibly rescue a significant amount of money along side lifetime of your loan.

Should you refinance the mortgage?

If the all you have to is actually a lower interest rate and you may monthly mortgage payment, then your option is easy. But if your re-finance requires be more advanced, you may need to become more careful when deciding on a lender to be sure you have made a reduced mortgage re-finance costs.

For example, state your financing is an enthusiastic FHA loan. You may also refinance to the a normal mortgage to eliminate mortgage insurance costs.

If you would like bring cash out after you re-finance, you are able to see that dollars-away browse around this web-site re-finance prices is a small more than fundamental refinance pricing. In cases like this, you want to be extra mindful to find the best refinance pricing that optimize your savings.