What are the Cons of utilizing the brand new Virtual assistant Recovery Loan?

Going common mortgage channel is difficult when you really need enhancements otherwise solutions. You should get financing into the home and you can an extra loan with the solutions that you will be think. With a few money means you have to make much more money which you can expect to disrupt your money.

Obtaining mortgage combined toward you to fee is likely to make monitoring they smoother. However, though some folks have a talent for remembering whenever bills are owed, other people may see the extra percentage, though the cash is a similar, because a performance bump which could send the financials spiraling regarding a beneficial cliff.

Everything you into the finance will not be easy otherwise safe. You will find flaws to help you a remodelling mortgage that can be a beneficial headache. You will be aware up until the process starts one to to purchase a home having restoration 's the beginning of a tense process. Keep head for the positive aspects but remember that demands are going to develop.

Virtual assistant Restoration Loan companies Shall be Hard to find

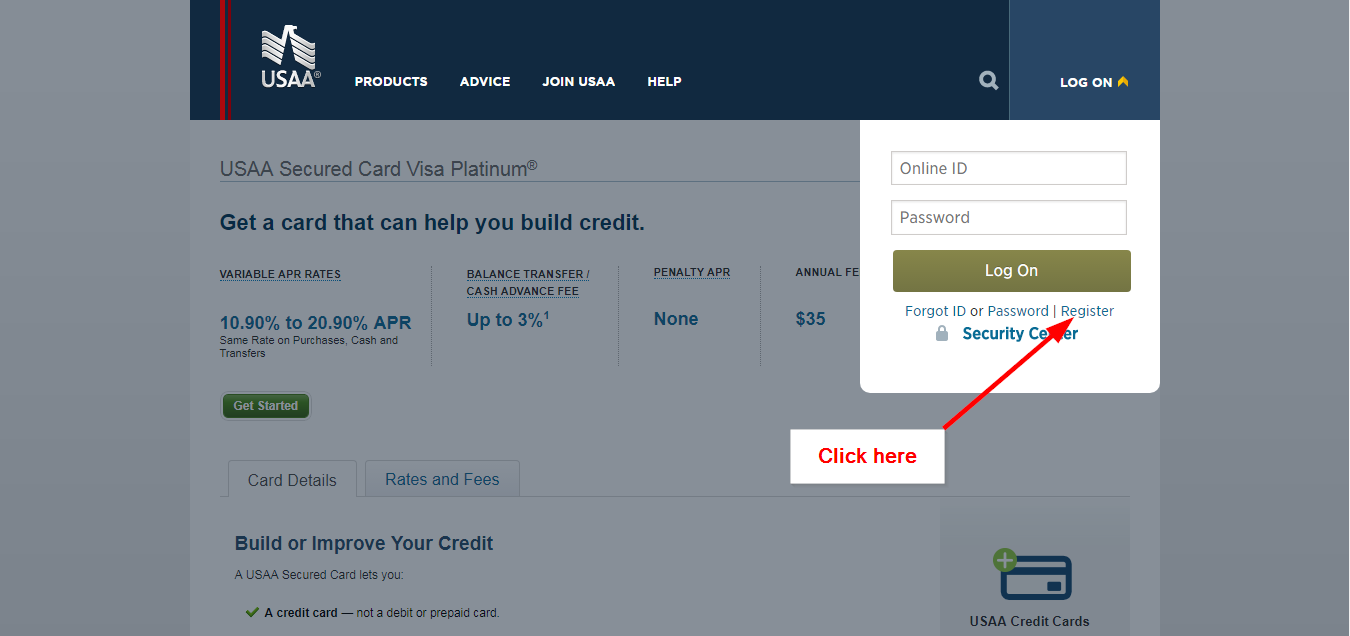

The amount of teams in the mortgage marketplace is adequate making your face spin. A large part of these might be got rid of because of the maybe not offering Virtual assistant money, as well as the other part can be disqualified to possess providing the house mortgage yet not the new Virtual assistant getting Restoration mortgage. Luckily, Effective Obligation Couch potato Income's within the-home lending cluster can help with Virtual assistant Recovery Financing find more you can aquire linked because of the filling out which inquiry form.

The borrowed funds needs loads of files and you can someone who has navigated the fresh new bureaucratic maze this is the Veteran's Administration. But not, businesses manage functions especially that have vets, of course, if you take some time and you may research your facts, you will want to already been out that have a family that just the loan you required for the place to find your dreams.

Particular Updates would be the Merely Products Anticipate toward Virtual assistant Restoration Financing

It could be a great downer for some which you can't create an extra area to store your own valued collection of military collectibles. The fresh new financing are only able to be used having improvements to switch the livability and safety of Veteran's home. For people who sustain services-connected handicaps, you need to make sure there are many issues that build your house much more available and you can comfortable.

There are even restrictions against change that needs to be adopted. Such, you simply cannot use the financing and also make people architectural alter into the the home. This means that there clearly was little threat of taking broken fundamentals or unsteady footings fixed toward financing.

There is Constraints on Count Youre Permitted to Repair

Among the many disadvantages of your Virtual assistant Repair loan is that you could perhaps not end up with most of the currency you will want to repair our home. A roof is positioned toward finance to keep people from entering money pits that will sink all of their money and place them inside a tough situation than just after they come.

The fresh new restrictions might also perhaps not meet the prices of your designers and you may derail the home to shop for process completely. If the quotes are not right for the house, it is better simply to move ahead and not stay. The process is full of demands, and these limitations improve market for your property a tiny part as to what would be an already stressed field.

Household Solutions Do not Affect the Quantity of the mortgage.

One of the issues that support young airmen, soldiers, sailors, and you will marines generate lifelong security is utilizing new Virtual assistant to shop for a home. But not, before you could take a trip down it street, you must know that making use of the Va Restoration mortgage simply allows one fix our house and not borrow for the precisely what the domestic might be well worth.