This allows consumers to access even more credit when needed with no to join up an alternate mortgage

To handle your own equity financial effortlessly, it's necessary to stay on ideal of your repayments and get away from borrowing from the bank outside of the setting. Regularly evaluating the loan words and rates of interest can help you identify chances to refinance otherwise renegotiate their home loan getting greatest terminology.

Into the Canada, security mortgages alleviate the fret of having so you can requalify in order to borrow from the equity of your house. You could potentially have a tendency to make the most of items like a home security credit line (HELOC) or any other financial loans secure resistant to the property. This particular feature is beneficial if you are looking to help you safer loans having an investment, done family renovations or reduce large-interest bills with no troubles from obtaining an additional loan.

You could often safer competitive interest levels underneath the guarantee financial in place of presenting you to ultimately highest-appeal loans otherwise credit cards. At exactly the same time, dealing with an established home loan professional can provide you with expert pointers and you can assistance in the life of the loan.

Trying to get a collateral Mortgage: Step-by-Step Publication away from

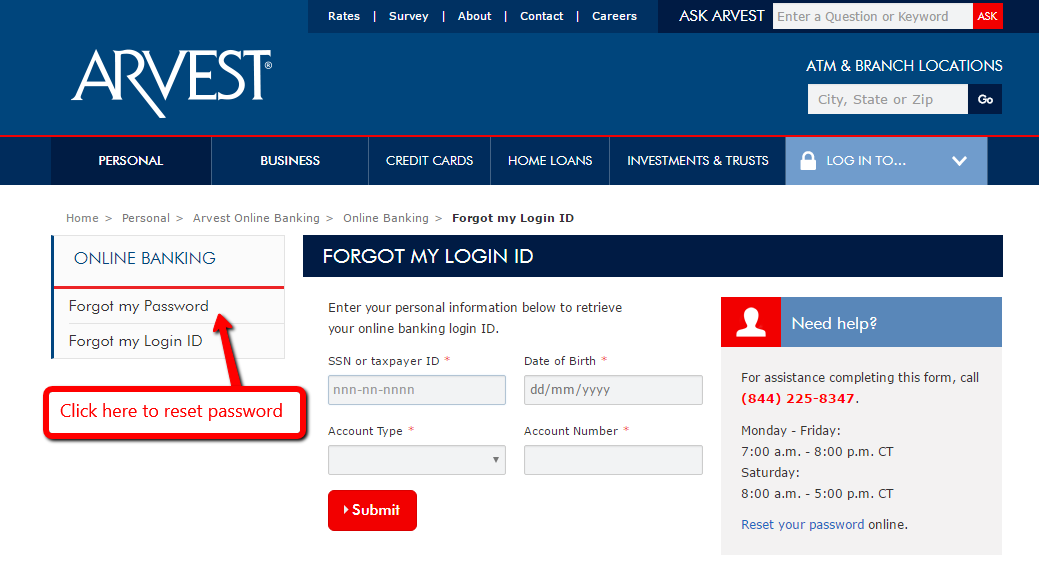

Making an application for a guarantee home loan that have is a straightforward procedure that starts with calling our financial pros. Might assess your debts, mention their borrowing needs, which help you choose best financial product for your needs. From there, might direct you from app procedure, ensuring most of the required files is filed precisely and you can effortlessly. After approved, you may enjoy the flexibility and you can reassurance which comes having an equity mortgage.

To summarize, collateral mortgage loans give Canadian people a flexible funding provider backed by the protection of their assets. From the focusing on how such mortgage loans really works, weighing their advantages and disadvantages, and you may following qualified advice to own dealing with them effectively, consumers helps make advised choices that assistance the a lot of time-term financial specifications.

At LendToday our team does this new hard work navigating from the some equity mortgage has so you don't have to. When you manage a skilled class off pros you could rest assured that our pros will thoroughly learn and you may see the different choices for you personally. Whether it is understanding the terms and conditions, evaluating the dangers in it, or exploring the prospective advantages, there is you protected.

The definitive goal is always to clear up the process for each and every debtor, rescuing them valuable time and effort. Entrusting home financing expert to cope with the causes of equity mortgages setting you can work with what counts really for you, be it expanding your organization, investing possessions, otherwise gaining your financial needs.

Tips for Handling The Collateral Home loan Effectively

- Would you get an additional home loan about a security home loan?

Sure, it is possible to receive the second financial behind a security financial. Although not, its important to note that an important bank holding new security home loan can get the original claim with the property's worthy of in case of standard. Therefore, delivering an extra mortgage are more difficult and generally speaking happens which have large interest rates and you may stricter credit criteria.

Techniques for Handling The Collateral Home loan Effectively

- Try collateral mortgages entered for your family worthy of http://clickcashadvance.com/installment-loans-pa/eagle?

When you look at the Canada, guarantee mortgages are often joined for over the first mortgage count, usually as much as 125% of your property's appraised worth. Although not, it is necessary to remember that the total amount registered doesn't necessarily represent the complete family worthy of but instead the potential credit strength available for the citizen.

Approaches for Handling Their Equity Home loan Efficiently

- Was a security mortgage increased interest than simply an everyday home loan?

Collateral mortgages might not has high interest rates opposed so you're able to old-fashioned mortgages, that can differ with regards to the bank plus the borrower's financial predicament. If you're collateral mortgage loans commonly provide competitive interest rates, they may come having high options will set you back and you will charges. Consumers need certainly to contrast pricing and you may conditions meticulously before you choose a good mortgage product to be sure these include obtaining best deal due to their means.