Because of no-down in addition to meager interest rates, the newest Va financing was broadening sought after

As well, those who don't have enough discounts have the option to help you forgo using money upon this type of mortgage.

3 USDA Financing

Since majority away from People in the us may not be entitled to Va money, it's good to remember https://paydayloancolorado.net/lakewood/ that they are able to still get the chance getting a no-off mortgage using financing backed by the brand new You.S. Service from Agriculture.

There can be a good caveat, even if. Our house youre to find should be based in an outlying town identified by the brand new USDA. Yet not, do not proper care if you believe you're required to begin a farm or equivalent. This new USDA loan is precisely a domestic financing.

One specifications you to definitely does create more complicated getting of several consumers is the house income limit. Simply because all of the adult who will inhabit our home should state the money on application for the loan.

Traditional Loan

Since you have an excellent 730 credit score, the right sorts of mortgage we might strongly recommend 's the old-fashioned style of home loan.

Conventional finance can be helpful, especially if you want to to find a good investment household, vacation home, or rental assets. As opposed to government-recognized mortgage loans, you'll have as much old-fashioned finance as you would like just like the there is no remain need for this type of financing. Whether you are utilising the house since an initial otherwise short term household will not matter to possess traditional loan lenders.

For every lender has its requirements and factors, nevertheless general idea is actually, the better your rating, the better home loan cost and also the highest loan amount you can use. Nonetheless, discover constraints.

Jumbo Funds

Traditional financing must follow the standards lay by the Fannie mae and Freddie Mac. When you need above the financing limits place by the this type of associations, you could get good jumbo financing. These jumbo finance continue to be thought conventional mortgages, but because they are a great deal riskier to possess lenders, they can not getting guaranteed by the Fannie mae and you may Freddie Mac.

The minimum credit history generally speaking required by jumbo loans try 680, making this also something you can imagine with a beneficial 730 credit score, specifically if you wanted more space or live in a very expensive venue.

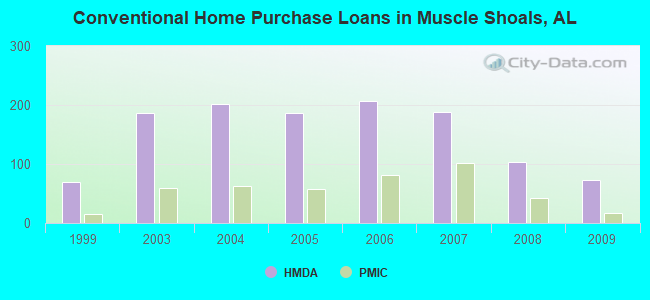

Jumbo loan or perhaps not, whether or not, old-fashioned funds will still be easier to government entities-backed FHA financing. The reason being conventional money are borrowed from personal loan providers, hence means there'll be personal financial insurance recharged to you every month, but only when you will be making a down payment of below 20 percent. Getting old-fashioned loans, you are permitted to create only step three% currency down, but in doing so, you'll have to continue purchasing private mortgage insurance policies unless you secure 20% home equity. Nevertheless, its a better package as compared to eleven several years of using home loan insurance rates to have FHA financing!

Adjustable-Price against. Fixed-Rates

Hopefully it's now a whole lot more visible what best option you should simply take for an effective 730 credit rating. But that's not all the! There was one other way we can define the sort of mortgage you are able to getting providing, and that applies to each other government-recognized mortgages and you will old-fashioned loans.

Whenever we should be class mortgages according to the style of interest rate you'll be bringing, there's two versions we are able to accept: adjustable-rates mortgages (ARMs) and you will fixed-speed mortgage loans.

Fixed-rate mortgage loans try effortless adequate to learn. Either you rating an effective fifteen-year or 29-year mortgage. The interest rate doesn't change to possess a fixed-speed home loan it doesn't matter how years you need to pay your loan. This can be high as it covers your if the rates drastically go up.