Is one to Get a home Collateral Credit line (HELOC) Through the FHA?

Lender Standards into the an enthusiastic FHA Cash-Away Re-finance

For individuals who purchased your residence via a federal Construction Government financing, you could fundamentally want to take out an enthusiastic FHA domestic collateral financing, called a house Equity Personal line of credit or HELOC. The newest FHA cannot provide FHA guarantee lines of credit per se, however they are available using individual lenders, such as for example banking companies, borrowing from the bank unions, mortgage brokers and you will deals and you may mortgage associations.

Family Equity Loan Definition

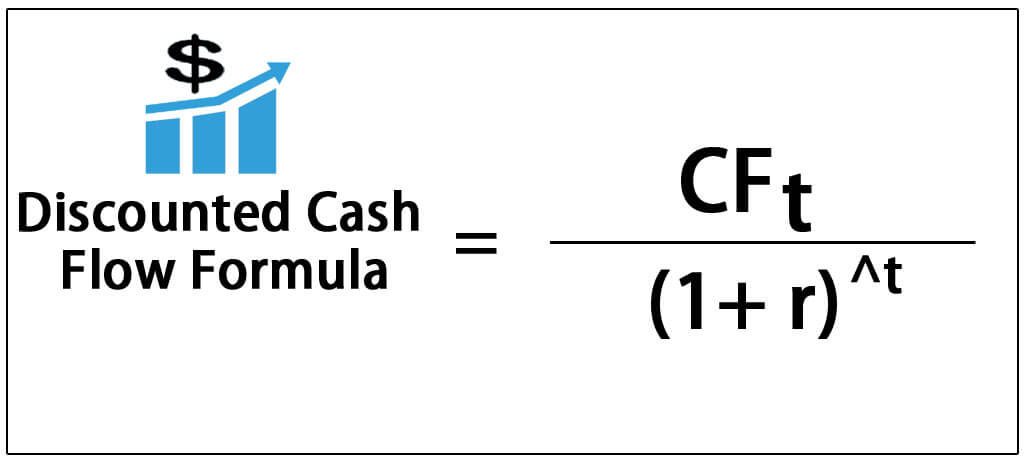

The guarantee one has in their house is the number left shortly after a resident subtracts the mortgages regarding property's fair ple, if a house features a good market value of $three hundred,one hundred thousand, plus the homeowner provides an effective $150,one hundred thousand harmony on the unique mortgage loan, their home security are $150,100000. Capable borrow against new guarantee from the house, but it's in place the second mortgage. Regardless if house collateral financing and you will HELOCs are usually put interchangeably, there clearly was a positive change between the two. This new citizen get a property guarantee financing inside the a lump sum, for them to use the fund having renovations or any other purposes, such as using a great kid's college tuition. House security financing repayments resemble a mortgage, for the reason that the latest citizen starts to pay off the loan monthly best away from the a predetermined rate of interest towards the lifetime of the new loan. Family security loans essentially range from five and you may 15 years.

As a personal line of credit, a beneficial HELOC is like a credit card. The brand new homeowner is draw with this line of credit having a good specified months, always around a decade. The fresh installment several months, although not, will get last for 15-to-two decades. HELOCs create more experience for those who need to pull out money for different ideas over a period of many years, rather than one major enterprise. As opposed to household security finance, which have repaired rates, HELOCs have adjustable interest rates. That means you could save very well your instalments in the event the desire cost development downwards, you might end right up spending even more if attract pricing surge up.

With an enthusiastic FHA mortgage, the newest borrower is needed to put down only step three.5 per cent of the purchase price if the borrowing from the bank excellent. People with all the way down fico scores have to set out about ten per cent of your purchase price, in either case, you to definitely advance payment automatically gets section of its guarantee. That have a normal financial, loan providers like to see consumers set-out at least 20 percent of your own cost. People that don't assembled this much regarding a down percentage need to pay financial insurance up until it achieve the 20-% collateral point. That have a keen FHA mortgage, the newest debtor need to pay mortgage insurance rates on life of new loan, regardless if the security are a lot more than 20 percent.

FHA Home Equity Mortgage Criteria

FHA domestic collateral financing feature lower interest levels than an enthusiastic unsecured loan, given that debtor uses new equity in their house because guarantee. To help you qualify for an enthusiastic FHA family guarantee mortgage, the latest resident should have an effective credit rating, and additionally no more than one or two late money along the prior a couple age. The mortgage, along with the home loan, do not take into account over 30 % of your homeowner's complete monthly revenues. The latest candidate should give facts he has got worked steadily in an equivalent profession for at least 24 months americash loans St Paul. A home-functioning citizen have to have got their particular team for at least 2 years, and you may furnish tax returns, this new business' profit-and-loss statements and you may similar records to confirm the income.

Every FHA domestic equity money are produced because of the personal lenders recognized of the FHA. You ought to comparison shop to search for the top cost and you may terminology for your home guarantee mortgage. But not, your lender may turn the actual best bet as you keeps a last with them. There is that your current lender retains their primary home loan. Should you declare themselves bankrupt or end up struggling to spend your home loan, ultimately causing property foreclosure, one to mortgage are paid down earliest. Another mortgage is only paid back on the continues of the foreclosure when the sufficient fund appear. Where terrible case situation, the financial features additional control when they keep both the basic and you may second mortgages.