Marketable Securities: Types, Accounting, Valuation, and Financial Impact

Financial documents are designed to provide insight into the financial health and status of an organization. To facilitate this understanding, here’s everything you need to know about how to read and understand a cash flow statement. Below is a break down of subject weightings in the FMVA® financial analyst program.

Debt Securities

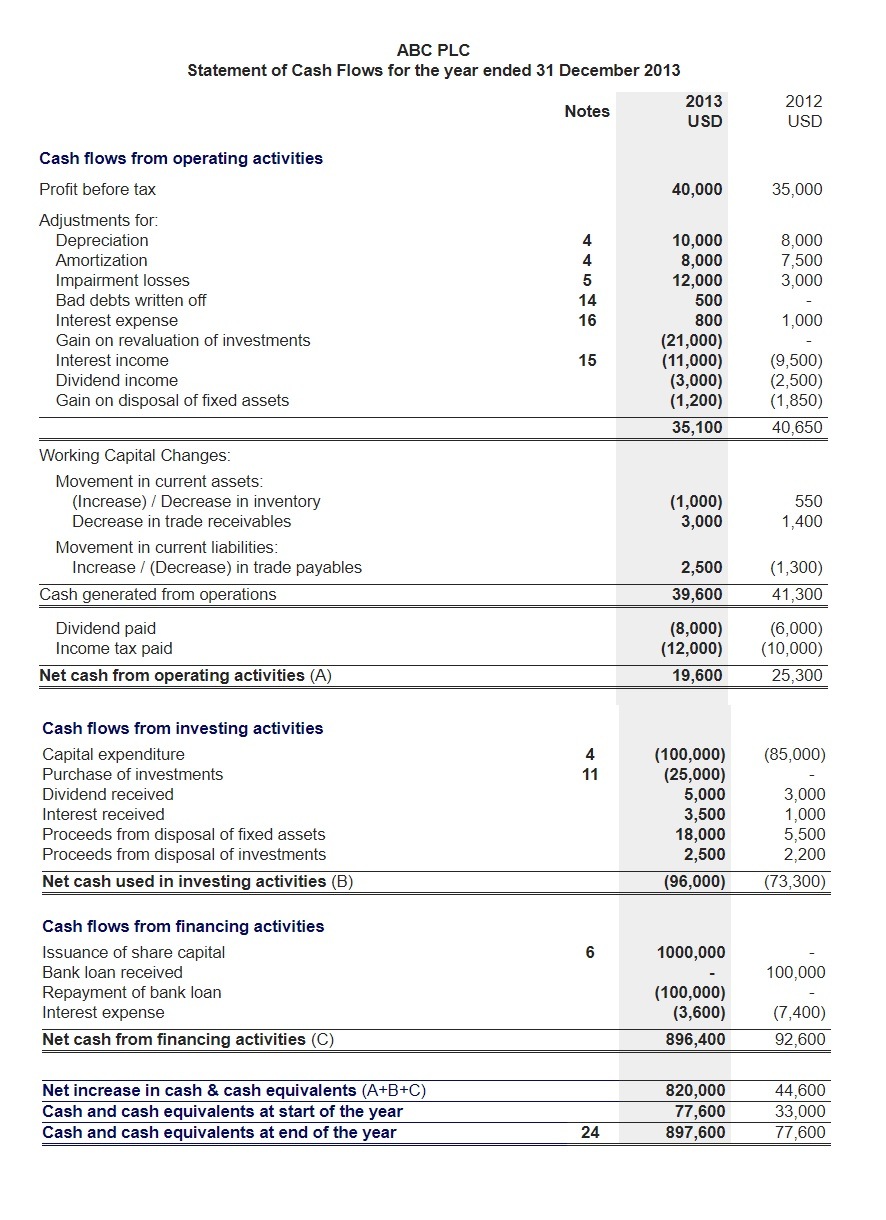

They can be calculated using the beginning and ending balances of various asset and liability accounts and assessing their net decrease or increase. Thus, when a company issues a bond to the public, the company receives cash financing. In contrast, when interest is given to bondholders, the company decreases its cash.

Cash Flow Statement: Analyzing Cash Flow From Investing Activities

These instruments are highly liquid assets that can be quickly converted into cash without significantly affecting their value. When reported on financial statements, investments in these types of liquid accounts are often combined with cash and represent a company's total holding of money and liquid investments. In this section of the cash flow statement, there can be a wide range of items listed and included, so it’s important to know how investing activities are handled in accounting.

Cash Flow From Investing Activities: Definition

However, creating and selling a product is not the only way a business can add to its bottom line. The CFS is distinct from the income statement and the balance sheet because it does not include the amount of future incoming and outgoing cash that has been recorded as revenues and expenses. Therefore, cash is not the same as net income, which includes cash sales as well as sales made on credit on the income statements. The operating activities on the CFS include any sources and uses of cash from business activities.

- Even though these securities don't promise to return the principal to the investor for 30 years, they can be sold relatively quickly in the bond market.

- They exclude financing assets or liabilities, such as short-term debt and other marketable securities.

- On CFS, investing activities are reported between operating activities and financing activities.

- Microsoft carries a much more conservative, liquid portfolio, as most of its investable assets are in short-term securities.

Fair value means the security’s fair value relates to the value the security will trade for on the market. For example, if a T-bill is trading at $104, the company will list the T-bill at a fair value of $104. That cost includes all costs to get the asset ready for intended use, including transportation, installation, and testing. These classifications are dependent on certain criteria, but also on the history of transactions any given investor or firm has employed in their past accounting practices. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Purchases and sales of these securities are recorded as cash outflows and inflows, respectively. Active management of marketable securities can thus affect a company’s cash flow from investing activities, providing insights into its investment strategy and liquidity management. Companies with substantial price earnings pe ratio formula calculator 2023 investments in marketable securities may exhibit more dynamic cash flow patterns, reflecting their efforts to optimize returns and manage liquidity. Marketable securities are defined as any unrestricted financial instrument that can be bought or sold on a public stock exchange or a public bond exchange.

These are also recorded at fair value, but unrealized gains and losses are reported in other comprehensive income (OCI) rather than the income statement. This treatment separates the impact of market fluctuations from the company’s operational performance, offering a clearer picture of core business activities. When these securities are sold, the accumulated gains or losses in OCI are reclassified to the income statement, ensuring that the financial impact is eventually recognized in earnings.

If a company has differences in the values of its non-current assets from period to period (on the balance sheet), it might mean there's investing activity on the cash flow statement. In general, negative cash flow can be an indicator of a company's poor performance. It can indicate that significant amounts of cash have been invested in the long-term health of the company, such as research and development. While this may lead to short-term losses, the long-term result could be significant growth and gains if those investments are managed well. This initial recognition sets the baseline for subsequent valuation and accounting treatments.