The attention review dates begin from the day the mortgage was disbursed

If for example the financing plan try pegged so you can a beneficial SORA speed, and that reset quarterly otherwise monthly, you have to make aside if you have a specific some time and day to improve button if you don't, you are at the mercy of a punishment payment (1.5% of the a good amount borrowed) once again!

Often the banks deter homeowners off redeeming the mortgage through to the go out the mortgage is meant to reset. Essentially, you will want to carry out into the second available redemption.

4. Full Debt Upkeep Ratio (TDSR)

To decide whether or not you need to re-finance or perhaps not, you need to discover how more affordable your anticipated refinancing package is actually. One should observe it may affect the TDSR and look whether the result is in your safe place.

The brand new secret to possess TDSR calculation is to bring your complete month-to-month debt obligations and you will split them by your disgusting monthly income.

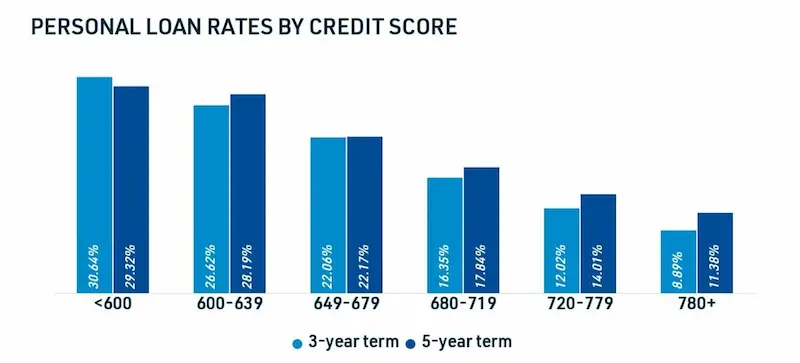

Credit score

Your credit score enables you to understand though refinancing in the a particular minute is achievable otherwise beneficial. By way of example, if the a borrower's credit history hasn't enhanced as history big date their application for the loan is rejected, it's likely to locate rejected once more through its earlier credit reputation. Is enhancing your credit history continuously prior to trying to help you re-finance once more.

The crucial thing to remember is always to perhaps not accept one highest credit lines or finance during this procedure as it have a tendency to change the give that the potential lender can make you, referring to a thing that might possibly be out of your manage shortly after complete.

On the other hand, be aware that refinancing mortgage might not be the best flow constantly. As the a citizen, you will need to observe long it takes to split even before you re-finance, we.age. how long it requires your own notice deals from refinancing to help you exceed that which you paid off so you can re-finance. It is a good idea to assess the break-even section providing your re-finance expenses into account.

Particularly, in the event the refinancing the home mortgage with a brand new bank will set you back $5,000 initial while you rescue only $100 per month with the the brand new home loan package, following to manufacture the newest refinancing worth every penny, you will need to stay-in the same house for at minimum fifty days which is merely more several years.

Generally speaking, brand new expanded the real estate loan title, the greater number of desire youre expected to spend. Additionally, finance which have quicker words are apt to have straight down appeal will set you back however, higher monthly premiums.

Yet, if your financial predicament changed because of a bad experiences, such breakup, layoff otherwise a primary medical debts or if you is actually struggling to meet with the monthly financial obligations, high month-to-month home loan repayments normally lay a strain in your financial disease.

This kind of a position, it's wise so you can extend payday advances loan the borrowed funds term and reduce monthly premiums because it's far better have a lengthier-name financial rather than exposure losing your property or destroying your own credit score through late costs. Just remember that , you can always shell out even more if you enjoys financing, but don't smaller.

Things to stop whenever refinancing?

Fundamentally, home owners need to pay judge and valuation charge after they re-finance. With regards to the property particular, this may costs all of them things between $2,000 to help you $step 3,000. Although not, repeatedly, financial institutions provide to subsidize this type of will set you back to help you incentivise home owners so you're able to refinance around specific points.

Such as for instance, many banking institutions is generally prepared to defray the fresh legal costs with subsidies should your a fantastic loan amount is actually significantly higher (above $five-hundred,000). Get in touch with a specialist mortgage associate who'll let it can save you throughout these charges.